Proxy data is valuable information used by investors, regulators and data aggregators. These kinds of issues cause confusion in the marketplace. Going forward, filers should review their proxy statements to ensure these situations are addressed.

Additionally, the US Congress joined the conversation on December 23, 2022 passing the Financial Data Transparency Act (FDTA) into law. The FDTA mandate compels the SEC to improve the quality of the machine-readable data it collects. In response, in September 2023, the SEC published a sample comment letter that it may issue to companies regarding XBRL tagging errors.

The challenges of XBRL tagging in the Proxy Statement

For many companies, 2024 is the second year of XBRL tagging for Pay versus Performance disclosure in their proxy statement. As the SEC continues to emphasize the importance of accurate XBRL tagging, important questions remain about the proxy statement.

- How do you ensure that there are no tagging errors in your proxy filings?

- Does your machine-readable (XBRL-tagged) data tell the same story as the human-readable proxy document?

While all companies focus on getting their Pay versus Performance human-readable disclosure content right, XBRL tagging errors in proxy occur more than they should.

1. XBRL tagging errors in the adjustments from the “Executive Compensation Amount” to the “Amount Actually Paid” (CAP).

It is no surprise that this information is particularly interesting to data aggregators. Here is an example of a common error.

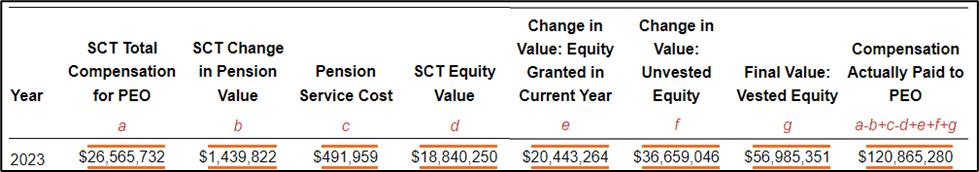

Example:

This table makes perfect sense in the human-readable document, as the company noted that the reconciliation is: a-b+c-d+e+f+g.

To ensure the XBRL tagging presents the exact same information, the XBRL preparer must know to enter values in column b and d as ‘negative’ (as deductions), even though the values in these two columns are shown as ‘positive’ (with no parentheses) in the table.

When XBRL preparers erroneously entered the values in column b and d as positive, the XBRL calculated value (machine-readable value) of the executive compensation actually paid would be a+b+c+d+e+f+g = $161,425,424 versus the value $120,865,280 as shown in the table.

Another common tagging error in this disclosure is related to filers who failed to set up a correct hierarchy to represent the breakdown of the adjustments. When this occurs, the XBRL calculated values of compensation adjustments are double counted and therefore the compensation actually paid cannot be calculated accurately in XBRL.

To tag this disclosure accurately, the XBRL preparer must possess in-depth technical knowledge on XBRL dimensions and hierarchy.

2. Incorrectly tagging the PEO and NEO

In the Pay versus Performance disclosure, the information pertaining to the “Principal Executive Officer” (PEO) is presented separately from the “Named Executive Officers (NEOs)”. NEOs are individuals “other than PEO”, or “non-PEO”. This is clearly defined by the SEC rule and in the proxy document.

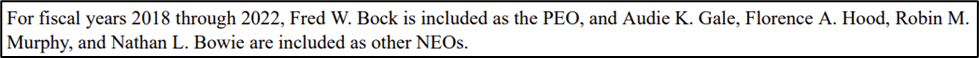

Example:

Filers have erroneously tagged the name of the PEO AND the names of all NEOs with the same element (PEO name). While the disclosure is clear to human readers (there is one PEO and four NEOs), the data consumed by the machine indicates that there are 5 PEOs.

In this example, only Fred W. Bock should be tagged as PEO (with element ecd:PeoName). The names of other individuals are NEOs; they should not be tagged with the PEO name.

Conclusion

Is the XBRL quality in your proxy filing at the same level as your disclosures? Tagging all the information accurately (so the data can be consumed by machine without issue) may not be as easy as it seems. With the increasing market usage of XBRL data and the SEC’s focus on data quality, it is important that your XBRL data tells the same story as the human-readable document.

Attention to details as well as robust XBRL technical expertise are both compulsory to handle the XBRL tagging as required by the complex SEC rules.

Contact Toppan Merrill to learn how to avoid these common mistakes and request a complimentary review of the XBRL tagging of the Pay versus Performance disclosure in your proxy statement. Looking to increase shareholder engagement? Download the latest Toppan Merrill Proxy Style Guide.