Structured data provides many benefits to investors, analysts and the SEC, allowing data to be aggregated and compared more easily across filers and filings. In 2020, SEC Commissioner Allison Heron Lee presented a compelling case for the benefits of modernizing Form N-PX reporting to an XML structured data format:

“Structured data is a pivotal factor in ensuring that EDGAR continues to live up to its original promise of revolutionizing investment decisions and enhancing the efficiency of the securities markets. The SEC must keep pace and continually evaluate how to enhance the usability and quality of data in our filings.

For example, proxy voting data. In 2010, the SEC issued a proposal [which included] structuring the Form N-PX voting data. Ten years later, however, we still have not finalized that rule.”

In November 2022, the SEC adopted the rule to modernize and expand N-PX reporting Enhanced Reporting of Proxy Votes by Registered Investment Management Companies; Reporting Executive Compensation by Institutional Investment Managers (Form N-PX). The amendments are designed to improve and enhance fund proxy vote disclosures. N-PX filers will need to be ready for the new requirements.

Highlights

- Form N-PX will be reported in XML (Extensible Markup Language) format

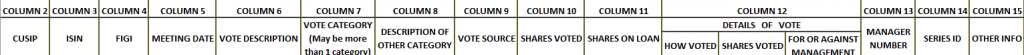

- The new Form N-PX consists of two portions:

- Cover and summary page with key information about the report and the fund/filer and

- Proxy vote record table

- Funds must categorize proxy record voting matters

- Funds must disclose the number of shares they loaned to another fund and did not recall

- Institutional investment managers (who file on Form 13F) will be required, for the first time, to report on Form N-PX how they voted their proxies relating to certain executive compensation matters or “say-on-pay” votes. See my blog for details.

- Managers that have a disclosed policy of not voting proxies must still file an N-PX notice report

- Managers may submit a request for confidential treatment requests to the SEC on new EDGAR form types N-PX CTR or N-PX CTR/A

Proxy vote categorization

One of the most contentious provisions of the rule is the new requirement for Funds to categorize their proxy votes. The SEC compiled a required list of fourteen categories ranging from routine corporate governance matters to DEI (Diversity, equity, and inclusion) and environment/climate or other social issues. In the final rule, the SEC states they believe this categorization will allow “investors to focus on topics they find important.” Funds will need to select one or more of the appropriate categories for each vote record. The new XML format will allow the vote categories to be tabulated and analyzed across Funds.

Affected filers

- Mutual funds, exchange-traded funds (“ETFs”), and certain other funds, including N-2 Closed End filers (all existing N-PX filers)

- 13F Institutional Investment managers who exercise “say on pay” votes (new N-PX filers)

Compliance timing and EDGAR N-PX testing environment

- The final amendments are effective July 1, 2024, to allow filers time to prepare for the new requirements. However, data needed for compliance in 2024 will have to be gathered starting July 1, 2023, since the first XML reporting period will run from July 1, 2023, through June 30, 2024

- The annual deadline for N-PX reports remains the same, August 31

- Beginning July 1, 2024, filers will need to submit Form N-PX in XML format for the most recent 12-month period from July 1, 2023, to June 30, 2024

- The SEC created a test environment on the EDGAR system to allow N-PX filers to prepare for the changes. From December 19, 2022, through June 30, 2024, filers may submit test XML N-PX filings

- Institutional Investment managers reporting say on pay votes on Form N-PX have separate compliance timing outlined here https://www.toppanmerrill.com/blog/new-n-px-reporting-requirements-for-13f-filers-institutional-investment-managers/

Jennifer Froberg, Senior Product Specialist at Toppan Merrill

With over 15 years of industry experience in the SEC regulatory landscape, Jennifer supports and advises clients in how to get their filings right. Part of a Toppan Merrill team of EDGAR experts who provide practical compliance expertise in a variety of subjects, Jennifer focuses on analyzing the scope of SEC rulemaking and where the agency is headed.

Toppan Merrill’s deep SEC subject matter knowledge provides companies with an array of pragmatic tools to navigate the frequently changing SEC requirements. Jennifer is immersed in how regulatory changes will impact the filers, investors and the market. She has a particular focus on structured data and ESG initiatives.

Resources

- Form N-PX Worksheets: https://www.toppanmerrill.com/sec-edgar-resources/form-n-px/

- SEC Fact Sheet: https://www.sec.gov/files/33-11131-fact-sheet.pdf

- SEC Final Rule: https://www.federalregister.gov/documents/2022/12/22/2022-24292/enhanced-reporting-of-proxy-votes-by-registered-management-investment-companies-reporting-of

- SEC Form N-PX: https://www.sec.gov/about/forms/formn-px.pdf