Seize the opportunity – let us handle the SPAC and de-SPAC SEC filings

In the SPAC lifecycle, speed and experience are paramount. Timelines are short – and unforgiving. Rules are ever-changing. Markets shift rapidly. To close a deal, you need to move quickly and confidently.

You need a partner and filing agent that provides extensive industry expertise with demonstrated experience in SPAC formation, ongoing regulatory compliance and de-SPAC transactions. That partner is Toppan Merrill.

Our global team of specialists, on-call 24/7, know every form type, filing standard and deadline inside-out.

We help navigate the complexities of capital markets transactions against the toughest deadlines.

Tested and trusted by

Rely on the industry leader for your SPAC/de-SPAC SEC filings.

The SEC registration process and the initial capital funding requires an experienced filing agent.

Our team of qualified experts has an impressive average of 23 years of SEC-compliant document creation. And as a market leader, we know the intricacies of the SPAC filing process. You’ll benefit from our complete understanding of the regulatory disclosure process, proactive guidance through strategic combinations and world-class support. Our singular goal is to support your SPAC formation, optimize the process and alleviate the burden of SEC filings.

And when documents need to be filed with the SEC, you can count on Toppan Merrill where we average 250+ SEC filings daily, with an impressive 99.998% EDGAR filing accuracy rate.

Your focus is now squarely on the next 3 critical steps of finding a target seeking to go public through a de-SPAC transaction, obtaining capital for the transaction and mitigating dilution. Life as a public company is hopefully short-lived for your SPAC, but while public, SPACs have reporting requirements just like every public company. It is critical to begin proactively preparing for post-IPO SEC disclosure. Toppan Merrill has the expertise and platforms to support you through post-IPO SEC reporting requirements, including the creation and submission of iXBRL tagged EDGAR documents.

You’ve found the perfect target. Now the de-SPAC process starts – and so do the SEC filings. Toppan Merrill can guide you through each and every step of the process while simultaneously preparing the target company for life as a public company.

By partnering with Toppan Merrill’s experienced professionals, companies are closing their capital markets transactions faster, easier and more cost-effectively. With our comprehensive de-SPAC transaction solutions, you can confidently focus on your deal while we handle the intricacies of the document and filing requirements.

Learn more about required filings here.

As a new public company, there are numerous SEC filings within the first 90 days of completing the de-SPAC transaction including your Resale Registration (resale of the shares and warrants issued in the SPAC’s IPO, and any shares issued in a PIPE transaction), corporate insider disclosure statements (Section 16 Forms 3, 4 and 5), registration of securities offered to employees (SEC Form S-8) and quarterly financial statements (SEC Forms 10Q and 10K). In a push for modernization and ease of investor access, most filings must be iXBRL tagged and/or submitted electronically. In addition to filings, SOX Compliance and Shareholder Communications (including Annual Meetings & Proxy statements) are required of public companies.

Successfully and confidently navigate the SPAC formation and de-SPAC transaction process.

Offerings

Project Management

Benefit from dedicated project management service teams who provide around-the-clock coverage to create, maintain and expedite your time sensitive work.

Composition

The SPAC/de-SPAC filing process is exacting. Enjoy peace of mind knowing that your dedicated service team has decades of experience and multiple quality checks in place to ensure your disclosure documents are perfect.

EDGARization

With a well-seasoned team, you benefit from quick and accurate conversion of documents into acceptable SEC EDGAR format.

XBRL/iXBRL

Dedicated XBRL/iXBRL subject matter experts know exactly what it takes to stay ahead of regulatory disclosure requirements and keep you in compliance.

SEC Filing

With leading technology solutions backed by world-class service and subject-matter expertise, we execute complex filings while navigating a world of ever-changing regulations.

SEDAR+

As an original adopter and tester of SEDAR, Toppan Merrill also specializes in Canadian Securities Administrators (CSA) submission standards and stays apprised of regulatory changes to ensure error-free filing.

Global Translations

Deliver, no matter the language, with Toppan Merrill translation capabilities in 14 languages.

Conference Facilities

Enjoy everything you need to work collaboratively, effectively and securely to get the deal done — global offices with state-of-the-art conference facilities and all the necessary amenities for your working group.

Printing and Distribution

End-to-end document creation including in-house printing and distribution, means you mitigate risk and ensure on-time delivery.

Why Toppan Merrill

Our team of qualified experts has an impressive average of 23 years of SEC-compliant document creation. Rest assured, with that tenure, we understand the intricacies of the SPAC/de-SPAC process. We have a complete understanding of each and every step to proactively guide and support your organization with best practices to optimize the entire process and ensure swift review and edit cycles so you can file against the toughest of deadlines.

Choose Toppan Merrill as your SPAC/de-SPAC filing agent for unmatched expertise and a proven process to guide your company through the intricacies of an SEC filing. Completing more than 62,000 SEC filings every year, we know the challenges and focus on providing comprehensive solutions that simplify the process and alleviate the burden on your organization.

Time is of the essence during the SPAC/de-SPAC process and we understand the importance of maintaining data integrity. Our technology delivers the speed and accuracy you can rely on from first draft to final printing and distribution with data quality checks at each stage of document preparation.

Markets don’t wait and neither should you. Our dedicated service professionals are committed to providing exceptional, 24/7 support.

You’ll benefit from our proactive partnership, whether it’s ensuring SEC fees are correctly calculated and the account is funded or validating all of the necessary exhibits are included and correctly linked in the submission.

Even with 250+ SEC filings daily, our team boasts a 99.998% EDGAR filing accuracy rate.

As a global company, we are staffed in every theater with specialists who are familiar with the requirements of the capital markets regulatory bodies around the world. Whether you’re listing in the Americas, EMEA or APAC, you’ll enjoy this global network of experts delivering fast turnaround, accurate document creation and on-time delivery.

Honest, accurate, and transparent, with no surprise outcomes. Proud to support corporations and their law firms, accounting firms and other advisors to facilitate the SPAC/de-SPAC process around the world.

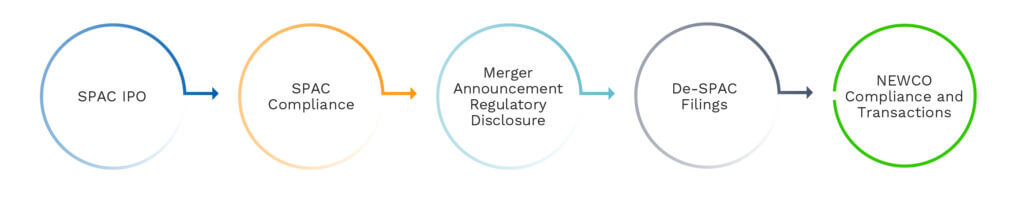

The Lifecycle of a SPAC: From Formation through the De-SPAC Transaction

With hundreds of SPAC and De-SPAC filings under our belts, we asked our experts to detail the lifecycle from prospectus drafting, to SEC filings to merger filings and post merger regulatory compliance and so much more…

SPACs: What the SEC knows and you need to know

The SEC has recently provided additional guidance related to SPACs. Learn more here.

Ways to go public: Benefits and risks of SPAC/DeSPAC, Direct Listing and Traditional Filing

Each route has unique risks and rewards. Learn more here.

Updates and Insights

Perspective from when airport systems went down and confusion unfolded. Life’s twists and turns can teach us valuable ADA lessons.

SEC mandates Inline XBRL for SPAC IPOs and de-SPAC transactions

SEC filing fee tables: How to convert and accurately apply iXBRL tags

“The Toppan Merrill team we worked with was absolutely the best! They went above and beyond to help us with the project, meet our deadlines and got edits in accurately. I will recommend Toppan Merrill on every project I have.”SPAC/de-SPAC transaction

Contact our team to get started.

Phone

Related Solutions

IPO Filing Services

Mergers and Acquisitions Solutions

Have more questions?

Reduce complexity and get answers to some of our customers’ frequently asked questions.

See the full list of FAQsThe Securities Exchange Act of 1934 created the U.S. Securities and Exchange Commission (SEC) and authorized it to govern the secondary market trading of company securities in the U.S. Secondary trading is the buying or selling of company securities (stock) typically through brokers or dealers. Often shortened to the Exchange Act of 1934 or the ‘34 Act, this landmark legislation laid the foundation for the financial regulation of public companies listed on stock markets including the New York Stock Exchange, American Stock Exchange and Pacific Stock Exchange.

XBRL stands for eXtensible Business Reporting Language. It is an open-source, XML-based standard for communicating and exchanging financial and business information.

The main purpose of XBRL is to facilitate the sharing of financial and business information in a standardized and efficient manner. It allows for the tagging of individual pieces of data within financial statements, making it easier to analyze and compare data across different companies and industries.

XBRL has gained widespread adoption around the world, particularly in the realm of financial reporting. It is used by regulatory bodies, such as the SEC in the United States, to require public companies to file financial statements in XBRL format, and by companies to communicate their financial results to investors and other stakeholders.

Divestitures involve the sale, closure or exchange of a business unit or portion of the business. Spin-offs often focus on separating business units with high growth potential. Divestitures help a company focus on its core business or expertise.

Divestitures can occur after a merger or acquisition. This allows a company to eliminate parts of the business that do not fit its strategic interests. Divestitures can be advantageous for reducing costs, generating capital and increasing strategic focus.

Divestiture is the act of shedding certain business interests. For example, General Electric shed its pharmaceutical business in 2020. Similarly, WeWork shed its software interests and refocused solely on its workspace-sharing business. For support and additional information, explore our Capital Markets solutions.